The easiest way to pick the best stocks to trade and invest everyday.

Stock screening can be easy.

NEW

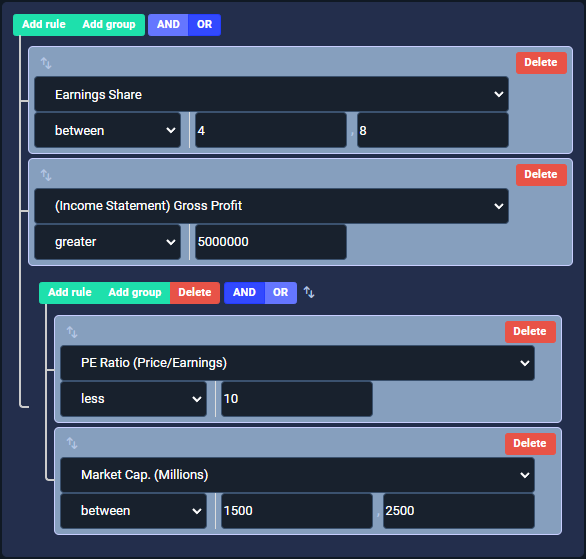

Intuivitive fundamentals screener

with 150+ metrics

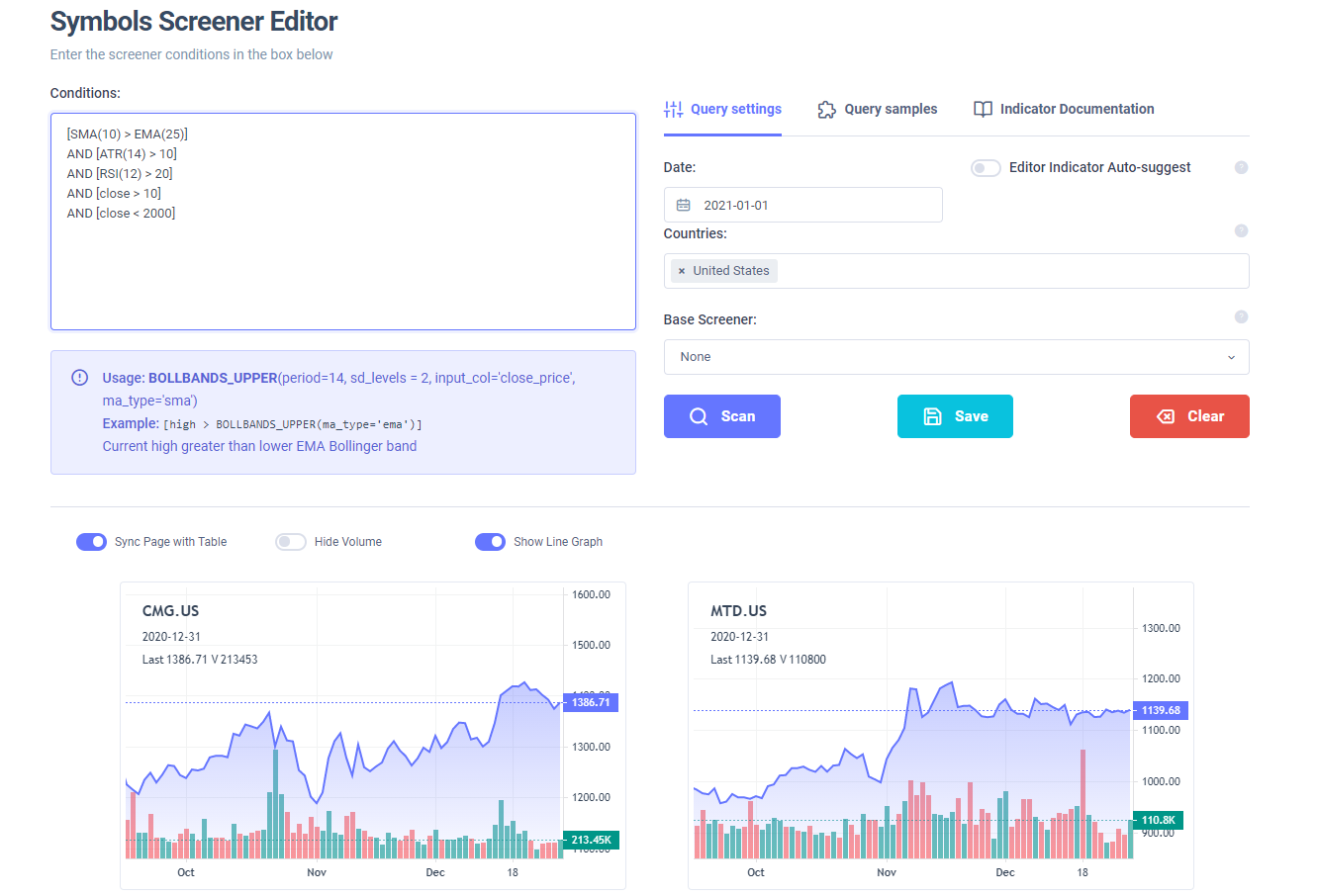

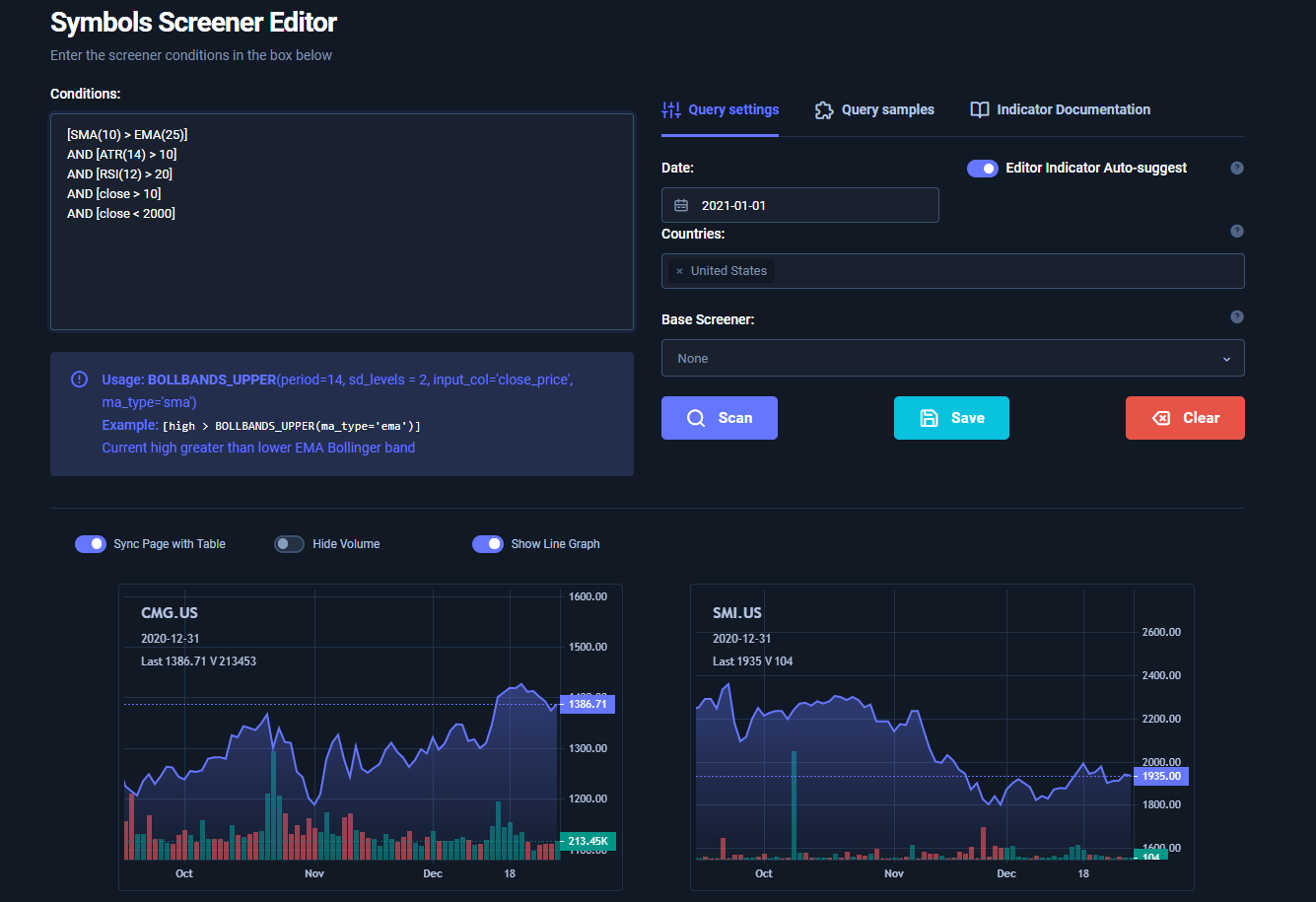

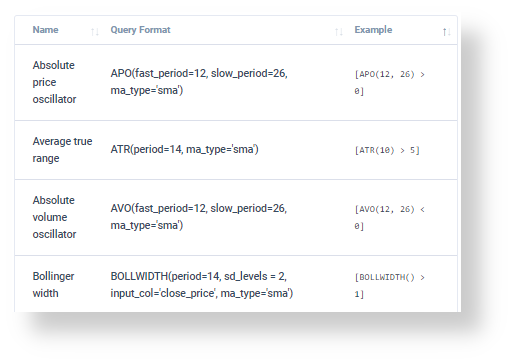

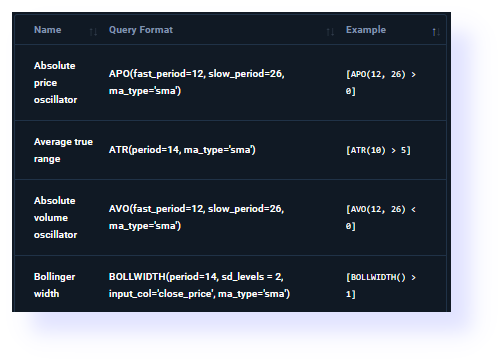

70+ Techncial Indicators

150+ Fundamental Metrics

Limitless possibilities.

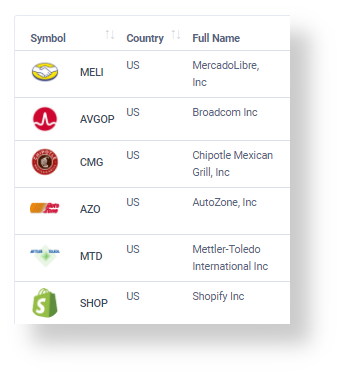

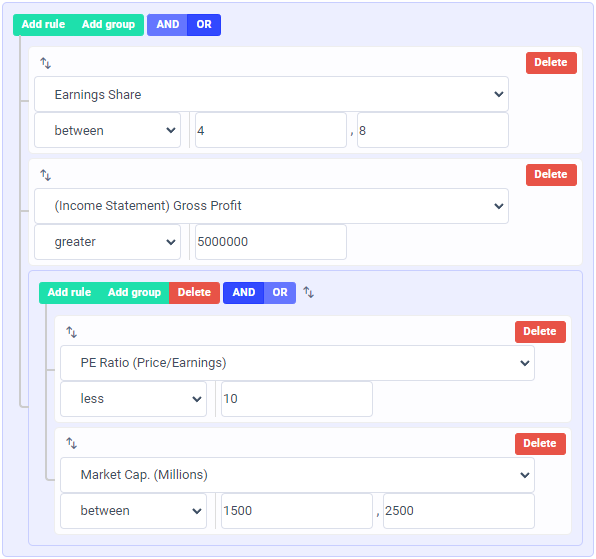

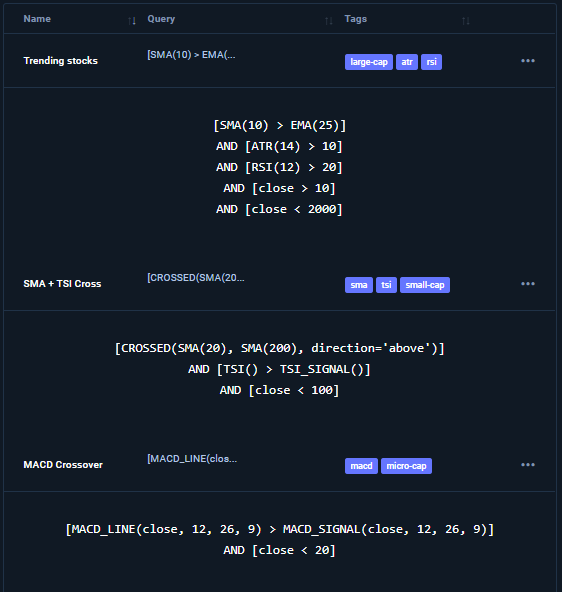

Create custom screeners utilizing easy to build query-based screeners

for both technical and fundamental metrics of any stock!

Find stocks not only to trade everday, but also to invest in longer terms with fundamental screener.

for both technical and fundamental metrics of any stock!

Find stocks not only to trade everday, but also to invest in longer terms with fundamental screener.

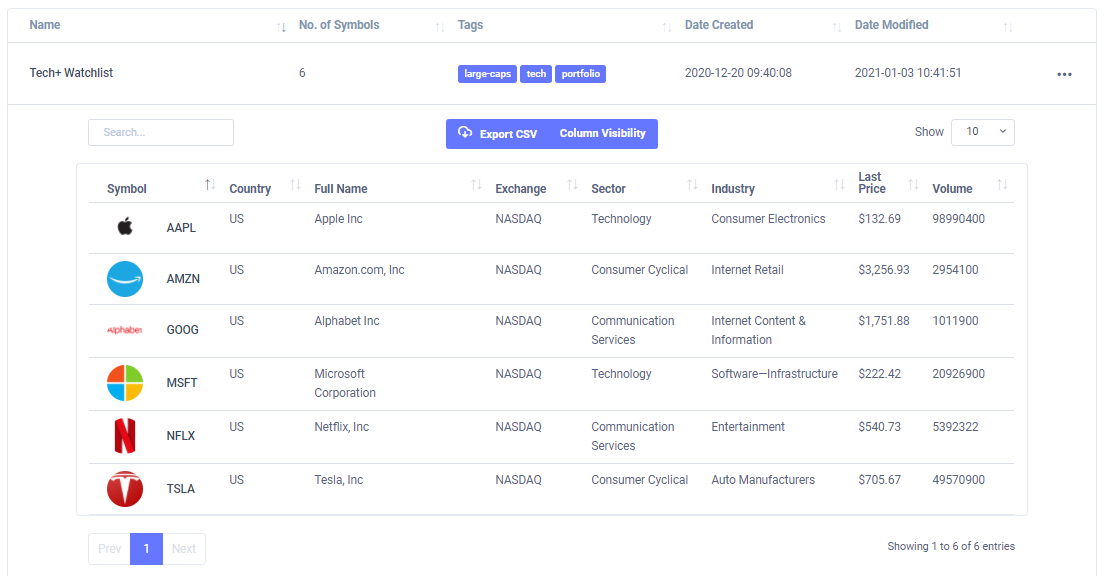

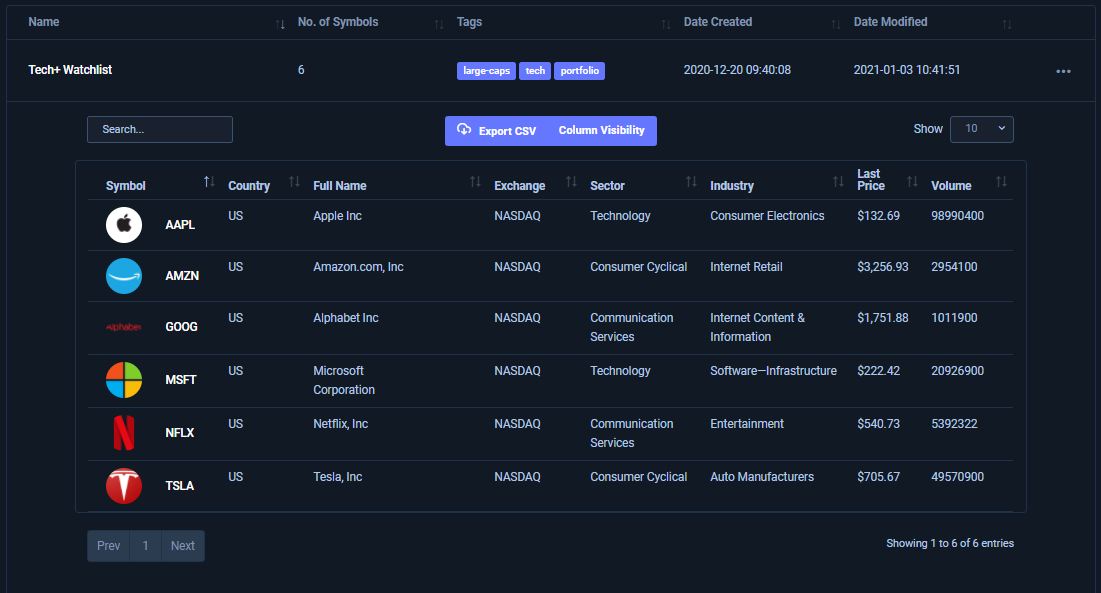

Simple watchlist

management.

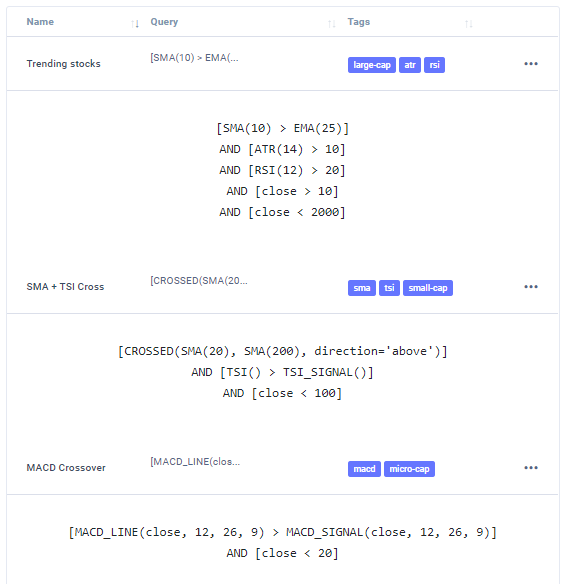

All your screeners

in one place.

- Add tags and organize all your screeners

- Edit/save any screeners for future reference

- Use base screeners for every scan you perform

- Search among your screeners using our interactive tables

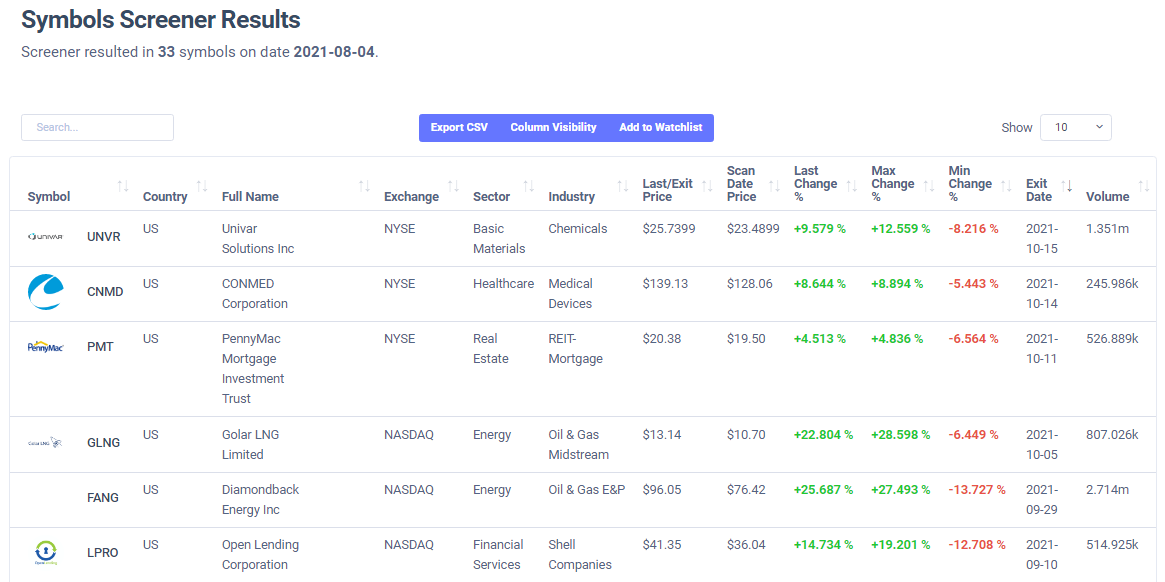

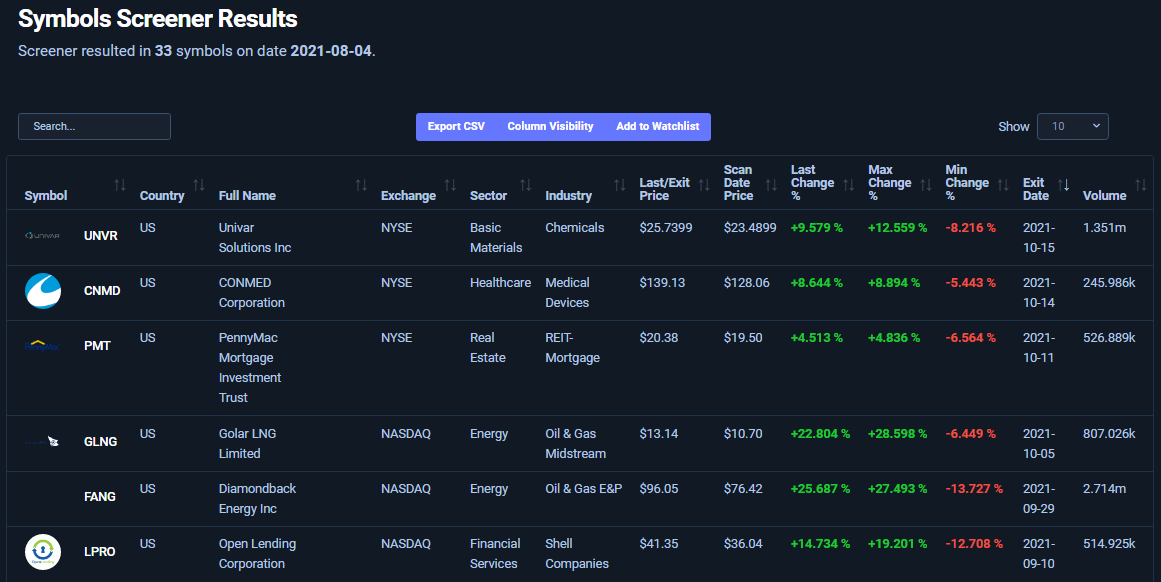

Easily backtest

your strategies.

Currently supported markets

Pricing

Always updated data, indicators and support for query building.

The best cost-per-feature online screener with the most extensive market coverage!

The best cost-per-feature online screener with the most extensive market coverage!

Pro

Start 3 Days Free Trial

$

/mo

- Unlimited screener possibilities

- 70+ technical indicators, 150+ fundamental metrics

- Combine technical & fundamental screeners

- Save all your screeners

- Watchlist management features

- Strategy backtesting features

- Query building support

Don't miss any opportunities!

Searching for good stocks to trade is like looking for a needle in the haystack.

Save hours of your time every day by creating scanners that do the work for you!

Save hours of your time every day by creating scanners that do the work for you!

Sign Up